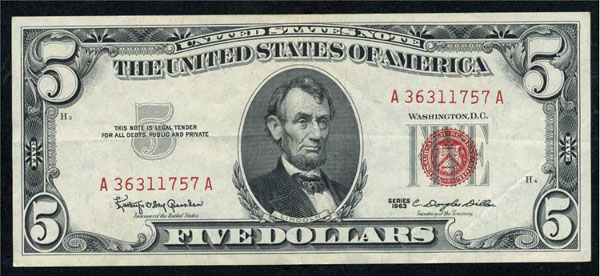

Specimen: A "United States Note" creates NO Federal debt BUT is still backed by gold NOT government gold BUT by market gold. Anyone can trade their dollars for market gold (about $1200 per ounce) When our forefathers created our Constitution they gave Congress the power to create the money that powers the US economy.

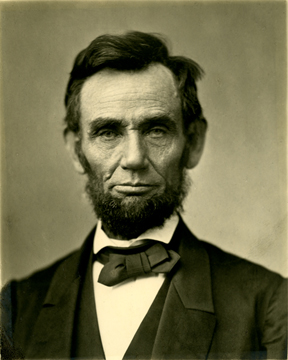

There are presently two kinds of U.S. "legal tender" dollars: the "United States Notes" and the "Federal Reserve Notes". For some mysterious reason the Treasury Department stopped issuing "United States Notes" in January 1971 and since then have issued only "Federal Reserve Notes" (debt notes). They said they didn't need both of them. A BIG MISTAKE THAT COST OUR COUNTRY TRILLIONS OF DOLLARS IN UNNECESSARY FEDERAL DEBT. This is when the bankers and bond dealers took over America, this is when our federal debt began to soar out of control. The "United States Notes" (characterized by a red seal and serial number), originally issued in 1862, were the first national currency. They were issued until 1971 when the Treasury suddenly stopped printing them. "Federal Reserve notes" were not issued until the creation of the Federal Reserve System in 1913. Both types of notes were redeemable in gold until 1933 when the United States abandoned the gold standard. Both currencies have the same value. Both currencies are U.S.legal currency, both are still valid. The "United States Notes" (no debt dollars) are a fiat currency (not backed by "government gold" since we went off the gold standard in 1933). The U.S. is not obligated to redeem them BUT they are still legal tender and are backed by the tremendous economic wealth and credibility of the USA (including gold). Dollars are still backed by gold NOT government gold BUT by market gold. Anyone can trade their dollars for "market gold" (about $1200 per ounce) They PRESENTLY ARE NOT BEING PRINTED - JUST START PRINTING THEM AGAIN !! - A VERY SIMPLE FIX !!

(verb: to Coin means to: create, invent, originate: i.e. "to coin an original phrase means to create a new phrase" - the same goes for new money - "to coin new money means create new money". ) The issuance of "United States Notes" unlike coined money, whose value was inherent in the metal that composed the coin, and are unlike "Federal Reserve Notes" which are backed by Treasury bonds and sold to the public who collect interest on them. A "United States Note" (greenback dollar) is a fiat paper dollar (an IOU) issued by the Treasury to pay the country's bills and other commitments. This fiat money has no tangible backing in precious metal, AND IS NOT BACKED BY THE GOVERNMENT BUT is backed by the tremendous economic wealth of the U.S. (about $90 trillion dollars at this time - 2017) and is still the "Legal Tender of the United States". (It says so on every dollar) It is the financial system that could power the U.S. economy and much of the world. BUT AS OF NOW THEY ARE NOT BEING PRINTED BY THE U.S.Treasury, so for all intents are in a state of suspended animation. GIVE US BACK OUR Greenback Dollars SO WE CAN START PAYING OFF OUR FEDERAL DEBT, LOWER TAXES, ETC.. JUST START PRINTING THEM AGAIN!! If the government wants the Federal Reserve to keep managing our money to prevent inflation that would be OK.

The "United States Notes" (no debt fiat dollars) create NO government debt. They cannot be considered debt because they pay no interest and U.S. government never has to redeem them BUT they are still the "official legal tender" of the United States, and thus are backed by the full strength, credibility and economic wealth of the USA and its citizens. They were in demand and accepted all over the world until their powerful presence was suddenly ended when the government stopped printing them in January 1971. The system we are using now is the Constitutional power of Congress to borrow money (when tax revenue in not enough) through the issuance of interest bearing "T-bonds". This method of creating money is managed by the Federal Reserve (Federal Debt Notes)which piles up tremendous amounts of unnecessary federal debt. It is a very bad system and should be revoked and begin printing our fiat currency once again. The "Federal Reserve Notes" are NOT fiat currency since they are backed by Treasury bond debt that are sold to the public by the Federal Reserve bond dealers, and must be redeemed by the Treasury when they mature. This is a very poor system and has created trillions of dollars of federal debt for the U.S. and made the dealers incredibility rich. Both of these two types of dollars have printed on the face of all U.S.dollars regardless of denomination. "THIS NOTE IS LEGAL TENDER FOR ALL DEBTS, PUBLIC AND PRIVATE". But the "Federal Reserve dollars" are NOT Fiat currency since our government is obligated to redeem them when they mature. This system has created trillions of dollars of unnecessary Federal debt for our country.

Note: This is a "Federal Reserve Note" that has created trillion of dollars of U.S. interest debt since the Treasury stopped printing "United States Notes" (no debt greenback dollars) in 1971 and printed only Federal Reserve dollars. Congress has the constitutional power to coin (create) new "legal tender money" - why doesn't it use this tremendous power?? Congress can create this new "legal tender money" backed by our country's excellent historic credibility and its tremendous economic wealth. It can then give this money directly to the US Treasury to pay our government's bills without going through the Federal Reserve System which just creates more national debt (this system has been a multi trillion dollar debt disaster). We must stop depending so much on tax revenue to run the government and let Congress create enough new money to run the economy properly. We can also begin to pay off the debt created under the Federal Reserve System. As long as the GDP wealth and dollar remain strong there is little danger of inflation in monetizing this wealth. Maintaining the proper strength of dollar is essential to controlling inflation. This will enable our government to give everyone a substantial tax cut and make up the difference in lost tax revenue by creating "United States Notes" dollars only. Let Congress authorize no debt "United States Notes" as our legal tender and stop or curtail printing "Federal Reserve Notes" as legal tender. Monetize the tremendous wealth of the US with "United States Notes" no debt dollars. We are the richest nation in the world (over $90 trillion dollars total wealth , $17 trillion annual GDP wealth) we've got to modify or get rid of the Federal Reserve System - its killing our nation with trillions of dollars of unnecessary debt and rising plus a flock of resessions and major depressions. Its a bad system letting our country be run by bankers. We've got to monetize our wealth by stopping the issuing of "Federal Reserve Notes" instead and only issue tax free "United States Notes". The "United States Notes" are issued directly to the Treasury to pay the government's bills. As long as the GDP wealth and dollar remain strong there is no danger of inflation in monetizing this wealth without creating more national debt. Maintaining the proper strength of dollar is all that is required. Both are "legal tender" and valid and backed by the wealth of our nation. Using the "Federal Reserve notes" the U.S. has run up trillions of dollars of unnecessary debt. The treasury bonds must be redeemed with interest. The brokers who sell these bonds profit greatly!! Beware Of Tariffs - When a person buys a product or service using U.S. dollars (IOUs) as instruments of the trade they are creating potential new wealth and jobs. When the domestic or foreign dollar holders return their dollars by purchasing American products they create potential jobs, more wealth. That is why tariffs are not good for the economy - they stifle trade and potential job creation. Tariff wars can destroy the world economy if let unchecked. One example of this US job creation potential - recently China put an order in for a large order of Boeing airplanes using its U.S. dollars that they were holding (from our purchases of Chinese products). This trading action will create additional American wealth, profits for Boeing and jobs for the workers and new American made airplanes for China. Its a win win situation for all involved.) Where does the demand for the dollar come from? Its only a piece of paper with some numbers, it pays no interest but it is the legal tender of the USA and is accepted in all government & commercial transactions. The number of dollars in circulation and the strength of these dollars are an indication of the wealth of our country. It is critical that we maintain a strong dollar but not so strong that we stifle trade. Controlling the strength of the dollar is critical to maintaining the health of our economy. The dollars in foreign hands actually represent potential job creation. The capitalists create the wealth that allows Congress to issue new dollars. As long as the capitalists keep creating tremendous new wealth Congress can authorize the creation of new dollars without fear of inflation. When Congress adopts a budget that is greater then the government's income. Rather then selling bonds which creates more debt, Congress has the potential power to create new money by issuing United States Notes directly by the Treasury - bypassing the Federal Reserve altogether and creating no additional Federal Debt. The American people stand ready to exchange their wealth (products, services, labor, food, businesses, stocks and bonds, real estate etc.) in exchange for their dollar IOUs. America is for sale (at the right price). If the Fed puts too many dollars in circulation then demand warrants, its value will fall. Apparently they have not done this because the dollar's value remains strong. If the dollar gets too strong our trading partners may stop trading with us and we may go into a recession. It is a case of simple supply and demand - print enough dollars to satisfy the demand but not too many that would cause over supply and therefore inflation. Keeping the dollar strength in balance is critical to the economic health of our country. The capitalists partnership with our government are the life blood of our country's economy - they generate the country's wealth - it is essential that we keep the our government's economic environment healthy so they can continue to create new wealth at a properous pace far into the future. At the present time the capitalists are generating hundreds of billions of dollars of new wealth (expanding GDP). Yet for some strange reason our government instead of monetizing our wealth and putting its new wealth to work prefer to issue more debt which must be repaid with interest. Our government has the constitutional power to create as many dollars as congress authorizes as long as the dollar is backed by the wealth (GDP) of our country. The GDP represents the wealth of the nation not the debt of the nation. This tremendous new wealth is the product of capitalism from the small farmer eking out a living to the large corporations creating billions of dollars of wealth, they all contribute to our country's wealth! This why communism failed! The communists either stifled or killed their capitalists. Without the capitalists their economic system was doomed! Every year that the capitalists maintain or create new wealth for the US. This new public wealth can be used to back the creation more "United States Notes" to pay for whatever are the needs of the country and cannot be considered as government debt. This new wealth is a product of the capitalists, the workers and the government that creates the opportunities for the capitalists to use. Most economists generally agree that large budget deficits and rising government debt are bad for the economy. The Democrats have proposed a mix of spending cuts and increased revenue in the form of higher taxes on the wealthy while the Republicans have rejected raising taxes and want to achieve deficit reductions through spending cuts and reform the large "entitlement" programs of Social Security and Medicare. I say neither solution is any good. The wealth created by our capitalist's tremendous productivity (GDP) should be invested in spending these billions of new "United States Notes" no debt dollars on any project that is needed without creating more national debt is the way to go. Issue interest free "United States Notes"(dollars) not T bonds or notes! Since the foreign investors together own trillions of US dollars (IOUs) it is in their interest to keep the value of the US dollar as high and stable as possible. It is in their interest to keep the value of the dollar high and stable. Too much supply of dollars could cause inflation with the value of the dollar depreciating for both the foreign and domestic holders but we are far from this condition. Although gold is a solid very valuable metal its value does vary it is only a commodity. Back in 1980 gold fell from $800 to $200. If the foreign U.S. dollar holders start dumping their dollars too fast their whole dollar investment could become unstable, so why would they do that? If anything they become wealthier when the dollar's value appreciates. Besides who would they dump them too?? As long as the U.S. maintains a strong, stable dollar this will never happen. Most foreigners are happy to accept the American dollar because of its universal purchasing power and credibility of the USA. Right now these dollars are the world wide currency. The foreign dollar holders get nervous when they think the Fed is printing too many dollar IOUs. This goes on all over the world, the holders of large amounts of U.S. dollars want to keep them as valuable and stable as possible. The dollar IOUs like gold pays no interest. MONETIZING OUR CAPITALISTS WEALTH CREATION. When the our capitalists are able to create new wealth for the U.S., Congress should be able to give tax cuts for everyone and begin paying off the Federal debt by issuing only "United States Notes" (no debt fiat dollars) rather then Federal Reserve Notes (debt dollars) which just create more debt. WHY DOES OUR GOVERNMENT BORROW MONEY AT ALL!!! (Thats like Warren Buffet taking a mortgage out to buy a house!) IT DOSEN'T MAKE ANY SENSE!!! As long as there is an equal supply and demand for the dollar it will remain strong. One way to keep the dollar strong is to keep importing foreign goods in exchange for our United States Notes (no debt dollar IOUs). This keeps the demand for dollars from foreign investors high and increases the potential demand for more American products. As long as the capitalists can keep adding to America's vast wealth our economy will remain strong. Congress can create more dollars without raising the prospect of inflation. The demand for the dollar remains strong this means the capitalists are creating more new wealth. The demand is greater then the supply so dollars value will remain strong and inflation will be low. This means that congress can authorize billions of additional dollars be created without rising taxes or creating more national debt or higher inflation. These new dollars could pay for the repair of the infrastructure (roads, bridges, etc) that we need so bad. With the trillions of American dollar IOUs circulating around the world - there is a tremendous amount of potential demand for American products, etc. out there. When the foreign holders of American dollars trade their their U.S. dollars for our products: industrial, commercial,realestate, businesses, stocks, etc. our economy benefits! Unemployment job would fall and American factories would hum again! That is why restricting trade is not good. As long as the capitalists keep producing new wealth the U.S. can monetize this new wealth with "United States Notes" and keep "Free Trade" intact the world will prosper. Beware of tariffs and taxes. by Donald Louis Hamilton © 2015, 2017 Author of The Mind of Mankind - Human Imagination - The source of Mankind's tremendous power! "The Mind of Mankind" "Changing the Course of the US Economy"

|